Our team has extensive experience in setting up companies in UAE's free zones. We understand the rules and regulations like the back of our hand, ensuring a smooth process for you.

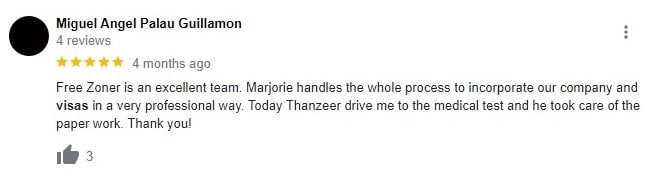

Every business is unique. That's why our services are tailored to your specific needs. Whether you're interested in offshore company formation in Dubai or exploring different types of company formation in Dubai, we're here to guide you.

We believe in openness. Our pricing is competitive and transparent. You'll know exactly what you're paying for from the start.

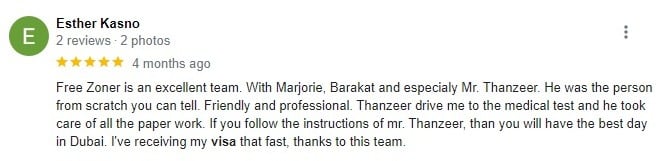

Our experts have years of experience. They'll not only help you register your company but also connect you with the right resources. We're your partners in every step of your company formation and business setup in Dubai UAE journey.

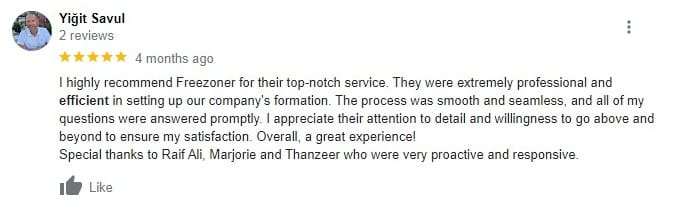

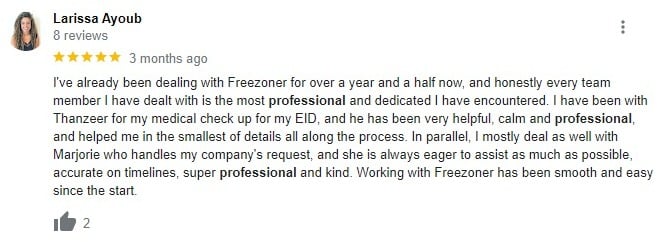

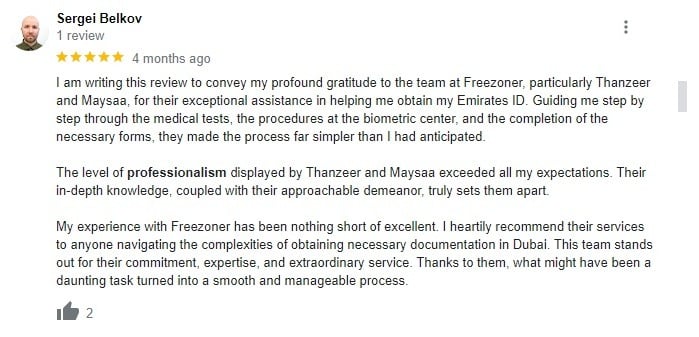

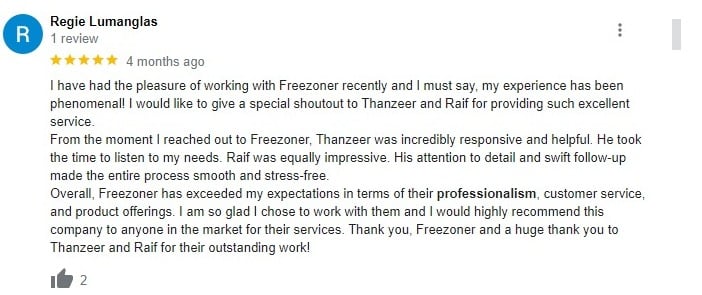

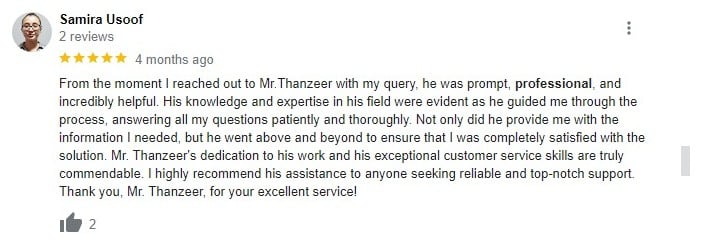

Your success is our priority. We treat every client with professionalism and respect. Our services are designed to accommodate your needs, regardless of the size of your project.

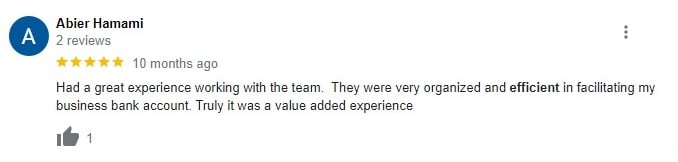

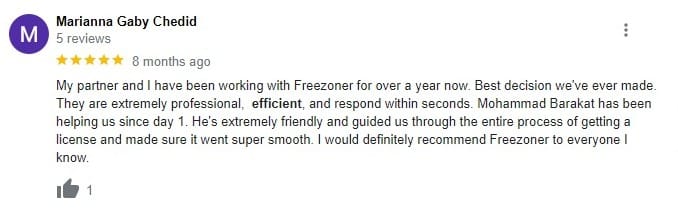

We don't just talk the talk; we walk the walk. Our reputation is built on trust, transparency, and delivering on our promises. When you work with Freezoner, you're in safe hands.

Our team has extensive experience in setting up companies in UAE's free zones. We understand the rules and regulations like the back of our hand, ensuring a smooth process for you.

Every business is unique. That's why our services are tailored to your specific needs. Whether you're interested in offshore company formation in Dubai or exploring different types of company formation in Dubai, we're here to guide you.

Our experts have years of experience. They'll not only help you register your company but also connect you with the right resources. We're your partners in every step of your company formation and business setup in Dubai UAE journey.

We believe in openness. Our pricing is competitive and transparent. You'll know exactly what you're paying for from the start.

Your success is our priority. We treat every client with professionalism and respect. Our services are designed to accommodate your needs, regardless of the size of your project.

We don't just talk the talk; we walk the walk. Our reputation is built on trust, transparency, and delivering on our promises. When you work with Freezoner, you're in safe hands.

The cost of setting up a company in Dubai varies depending on factors like the type of business, the location, and the services you require. Our transparent pricing approach ensures you're fully informed about the costs involved from the beginning.

Setting up a small company in Dubai involves several steps, from selecting the right business type to fulfilling legal requirements. Freezoner’s experienced business setup consultants in Dubai can guide you through the process, making it easier for you to establish your small business.

Company formation in Dubai offers numerous benefits, including a strategic location, a business-friendly environment, tax advantages, and access to a diverse market. With our expertise in company formation in Dubai, we can help you tap into these advantages.

Dubai's strategic location, modern infrastructure, and business-friendly policies make it an attractive destination for companies worldwide. Setting up an office in Dubai opens doors to a dynamic market and various growth opportunities.

A freezone company is a business entity set up in a designated free zone area. These zones offer benefits like 100% foreign ownership, tax exemptions, and streamlined regulations. Our team is well-versed in assisting with the setup of free zone companies.